Summary:

Here are the key points of the page:

* Over 75% of firms using accounting outsourcing providers find it profitable.

* The number of firms using outsourcing providers is expected to grow from 30% to almost 39% in the next 12 months.

* Two common accounting outsourcing models are:

+ Staff leasing (provider provides a raw accountant with minimal training)

+ Full outsourcing (provider handles HR, training, and support)

* BOSS offers a unique blend of full outsourcing and staff leasing, providing flexibility and high-quality support.

* The staff leasing model can lead to added burdens and costs, while full outsourcing can be more effective in the long run.

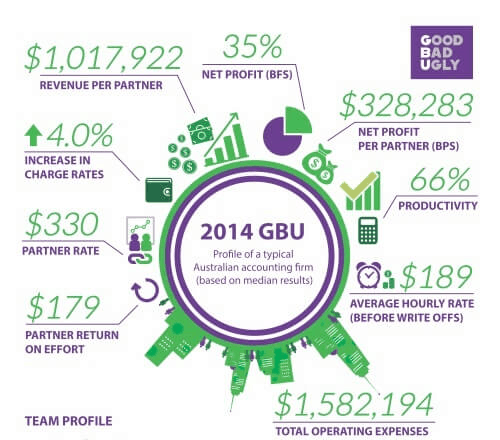

* The full 2014 Good Bad Ugly report is available for download from the Business Fitness website.

Business Fitness released the complete 2014 Good Bad Ugly report.

One noteworthy aspect of the report is the involvement of accounting outsourcing providers.

More than 75% of companies utilising outsourcing services report that it yields financial benefits. The proportion of firms employing outsourcing providers is projected to increase from 30% to nearly 39% within the next year. Key motivations for this shift include facilitating a transition towards offering more advisory services and preserving a competitive edge as compliance costs come under scrutiny.

In the Good Bad Ugly report it is stated that there are two types of accounting outsourcing model:

- Staff leasing

- Full outsourcing

Typically, staff leasing involves the outsourcing provider supplying merely a desk, a computer, and an untrained accountant—often lacking knowledge in Australian tax regulations or relevant software. (While some providers offer training, it generally remains at a fundamental level). However, staff leasing enables the outsourced accountant to adhere to your established procedures and working documents.

In contrast, full outsourcing means that the accounting firm managing the outsourcing handles all aspects of HR and recruitment. This includes ongoing training concerning Australian tax law as well as work papers and procedures when necessary. It also offers continuous support to ensure tasks are completed efficiently; thereby allowing the Australian accounting practice to simply assign jobs without additional complications.

BOSS is fairly unique in that we actually provide the best of both worlds: all the training and support of full outsourcing and the flexibility of having a dedicated accountant that can follow your procedures and working papers. (We even provide the option of having jobs reviewed so that they are ready for Partner level review and sign-off.)

See: https://boz.com.au/virtual-accountants/

BOSS notes that:

With the staff leasing model there may be the perception of cost savings but the reality can be that the savings become negligible with the added burden and problems with this arrangement.

Trying to recruit personnel, train staff on an ongoing basis to a high standard, monitor them and comply with APESB and TPB guidelines on outsourcing is no easy feat. In addition you may need to provide software licenses or have connectivity issues if you are not using cloud software.

There are firms who have tried the staff leasing model and are now moving to the full outsourcing model to make outsourcing work better for them.

The Good Bad Ugly Executive Summary and full report can be downloaded from the Business Fitness website here

2024 Update:

What is unique about the BOSS outsourcing model:

Specifically, BOSS provides:

- Fully trained accountants and bookkeepers who are continuous trained on Australian tax law, work papers, and procedures

- Full direct access via email or Skype with your outsourced accountants

- The option of having jobs reviewed to ensure they are ready for Partner level review and sign-off

- A dedicated accountant who can follow the client’s procedures and working papers

- All work performed on a fixed-fee basis (and costs agreed upon before starting)