This article was kindly provided by Craig West of Succession Plus

Business strategic succession planning was never heard of 10 years ago – however, business owners now understand that succession is a significant aspect of the success of their business. Steven Covey’s habit number two is Begin with the End in Mind – Covey says “if you want to have a successful enterprise, you clearly define what you’re trying to accomplish…. the extent to which you begin with the end in mind often determines whether or not you are able to create a successful enterprise.”

What is Strategic Succession Planning?

Strategic succession planning encompasses all facets of the business, with a primary emphasis on the ultimate objective. What are we truly striving to achieve within our organisation? Is it a means to finance our retirement? To go public on the stock market? To secure additional funding and expand? Or perhaps, to transfer ownership to future generations?

Effective strategic succession planning entails a comprehensive and well-documented strategy that consistently propels us towards our desired exit destination. Often, business owners find themselves consumed by the demands of daily operations, leaving them little opportunity to dedicate the necessary time, effort, and focus towards their long-term goals.

Why Strategic Succession Planning?

Currently, in Australia, over 50% of business exits result in failure, such as bankruptcy, liquidation, death or serious illness, divorce, or simply closing the doors. This unfortunate outcome is primarily due to a lack of succession planning by business owners.

According to a survey conducted by the Monash University Family and Private Business Research Unit, it is estimated that around 60 percent of private business owners will be reaching retirement age in the coming years. This is particularly significant as the first baby boomers turned 65 in 2011. As a result, there will be a substantial transfer of ownership and assets, totaling approximately $607 billion.

In addition to this, it is expected that about one-third of Australian family businesses will undergo CEO changes within the next 3 to 4 years. While over half (53%) believe that a family member will take on the role, a whopping 83% do not currently have a succession plan in place. This is concerning because many people start their own businesses with the intention of not only earning an income but also building equity value for future sale. Unfortunately, statistics show that most entrepreneurs never reach this point of successfully selling their business.

When?

From my perspective, strategic planning is heavily reliant on time. To illustrate this, consider whether you would approach a real estate agent today to sell your property this Saturday. While some agents might manage to accomplish this, the lack of time for marketing, property preparation, and buyer database review would result in a lower price than what the property is truly worth. The businesses I collaborate with typically require at least five years to maximise value and adequately prepare for successful value extraction.

Business media often highlights stories of wealthy entrepreneurs who make significant profits by “trading” in businesses. They invest, build or grow the business, mitigate risks, and exit lucratively within a few years. This serves as an excellent demonstration of executing an exit strategy correctly—an ultimate measure of success for these investors. Failure to execute an exit plan effectively often leads to no profit whatsoever.

How?

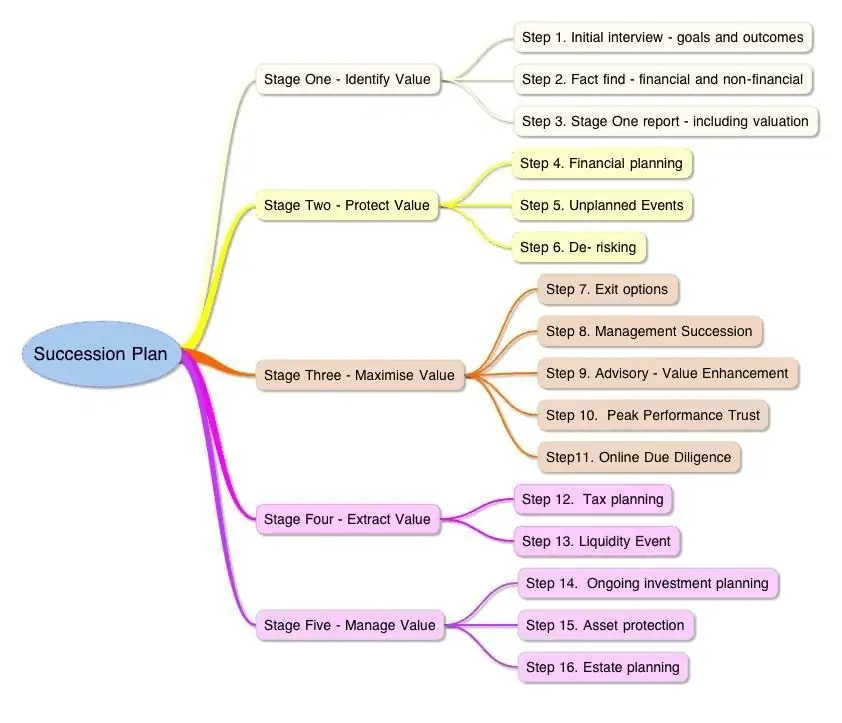

We start our comprehensive 16 step process by thoroughly evaluating the current state of the position. Through extensive due diligence, benchmarking, structural review, and valuation, we gain a deep understanding of the existing conditions within the business. This analysis allows us to identify both opportunities and challenges that may impact the ultimate exit strategy.

Most business owners do not have a pre-established exit plan and are often unaware of all available options. That’s where our strategic planning process comes in – we pinpoint the most suitable option(s) and outline what needs to be done to maximise potential opportunities. Often, several areas within the business, both financial and non-financial, require attention before implementing any exit plan.

During our review process, we carefully assess the business owner’s goals in order to determine the most suitable exit strategy. Our objective is to guide the business towards a successful transition. One approach that has yielded positive results is a management buy-in, whereby key individuals within the organisation are retained and motivated through an innovative employee share plan known as Peak Performance Trust. This arrangement allows these individuals to acquire shares based on a profit sharing agreement, with the funds being reinvested into the equity of the business rather than distributed as cash payments.

This strategic plan is designed for the long term and offers the added advantage of attracting, retaining, and motivating key personnel within the company who now have a personal financial stake in maximising its value, just like the owner does.

While this approach may not be suitable for all business owners, it has proven to be highly successful with some of our clients, as highlighted in the breakout box below. Regardless of whether or not a business owner decides to pursue an exit strategy, having clarity on which option is most appropriate and what steps can be taken to achieve a better outcome allows them to focus their attention and efforts on enhancing operational efficiency, profitability, and risk reduction—all factors that contribute to overall value.

In fact, we have worked with several clients who ultimately chose not to sell their businesses after implementing this plan. The transformed state of their businesses proved less stressful and better aligned with their desired lifestyles and retirement planning goals.

For business owners, it is crucial to approach every decision with the end goal of their exit strategy in mind. This means investing time and effort into developing a strategic succession plan, as it is one of the most significant financial decisions a business owner can make. Without a proper plan in place, the value of the business will retire along with you. It is important to always be prepared and consider whether each decision brings you closer to or further away from your ultimate exit strategy.

BREAKOUT BOX – CLIENT CASE STUDY

In terms of real business benefits this client ( a real estate agent in Queensland ) focuses on the sales people who are now able to state that they are owners ( often vendors want to deal with the principal of the business not “just an employee” ) – there was a strongly positive response from our staff. One of the great advantages to this scheme is the power that it gives to the employee in their negotiations. They can represent themselves as having ownership in the business, which is something that most competitors cannot offer. It’s like a trump card to a high performing sales consultant in their winning the listing in a competitive environment.

Interestingly, in this business, internal referrals between departments have also increased – both financial services and property management referrals from employees participating in this scheme increased at a higher level than before. I put this down to their seeing value in contributing to the company’s bottom line because they will share in the profit.

Principal Brett Greensill, is a strong supporter and based on the improvements in business performance and valuation his view is that all business owners should be looking at a similar plan – the introduction of this scheme is entirely positive. Succession Plus has been advising businesses in management, taxation and accounting issues for over 15 years. They specialise in business structuring and succession planning and have had extensive experience working with clients to improve their financial performance – with proven results.

For more information visit www.successionplus.com.au or call Craig West on 1300 665 473