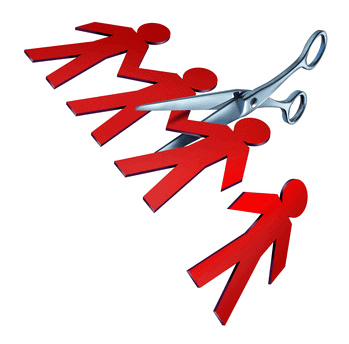

An astute entrepreneur understands the importance of discerning valuable business connections from those that are not. However, regrettably, many individuals neglect to evaluate their client roster objectively and rid themselves of unproductive or problematic clients due to the fear of experiencing a financial decline. When was the most recent occasion in which you assessed your list of clients with the intention of eliminating those who bring more difficulties than benefits or do not align with your ideal client profile?

Strategically evaluating and refining your client list is a crucial aspect of successful business management. It is essential to approach this process in a professional manner, recognizing that it is not personal but rather focuses on the value each client brings to your business. As noted by Anthony Davis, a partner with Hinshaw & Culbertson LLP based in New York, implementing such a strategy has proven to be effective. Additionally, Davis offers valuable advice on this matter, emphasising its significance for businesses.

“Being selective is key. I choose only those clients who meet my predetermined criteria in regards to the type of work and fee-paying capacity.”

Deutsche Bank, a professional service firm, understands the importance of maintaining a top-quality client list. They diligently monitor their clients and make adjustments when necessary. Recently, they have made the decision to close accounts for customers whose investable assets no longer meet the new thresholds. These firms recognize that customer selection and retention criteria play a vital role in shaping the success of their business, alongside their valuable human capital.

The practice of client culling involves actively seeking out and identifying the ideal clients for your business. By doing so, you can streamline your client base to focus on those who are the best fit for your services. This strategic approach allows you to allocate internal resources more efficiently, resulting in improved service for your current clients and increased opportunities to offer additional value-added services. Moreover, by redirecting budget from managing poor-fit clients toward finding more “best fit” clients, you not only enhance profitability but also create a more enjoyable work environment.

Ending a client relationship can be a delicate process. One approach is to gradually phase them out without explicitly stating that you will no longer work with them. With some luck, they may not even realise that you are no longer pursuing their business. This tactful solution allows you to save time by not chasing unproductive sales while also avoiding potential negative word-of-mouth from offended contacts.

On the other hand, using the aforementioned method might be time-consuming and ineffective in removing certain difficult clients. A more proactive and targeted strategy would involve finding another accountant who can better cater to their specific needs. For instance, if your desired client is a rapidly expanding business, you could refer a low-value, uncomplicated “ITR client” to a local accounting firm that specialises in handling high volumes of quick tax returns. Alternatively, you could negotiate an agreement with this high street firm for a referral fee.

One strategy to implement is to send a formal letter outlining the changes within your business and how it has resulted in a shift in your target clientele. It is important to emphasise that your services are now exclusively focused on catering to businesses. Additionally, make personalised recommendations for alternative firms that would better accommodate their needs. Timing is crucial, so it is advisable to dispatch this letter a couple of months before the busy tax season begins. The objective here is to politely communicate that the client would benefit from engaging with another firm that aligns more closely with their requirements. Moreover, it would be advantageous to have a specific alternative provider in mind, ensuring that the client feels supported throughout this transition process.

Potential criteria for ideal clients:

- In business for at least three years

- Pleasant, outgoing personality

- Willing to listen to advice

- Positive disposition

- Technically competent

- Business is profitable

- Business is not chronically under capitalised

- Business is not dominated by a small number of customers or suppliers

- Clearly established demand for the product or service

- Business has a scope for product or service differentiation through innovative marketing

- Business has scope for improved productivity through innovative management planning and control

- Business has a strategic plan

In addition to the aforementioned client selection criteria, it is beneficial to consider the following:

- Prompt payment history

- Annual revenue returns

- Potential for growth

Your customers are the lifeblood of your business. They play a vital role in shaping your operations, performance, reputation, and ultimately, your bottom line. It is crucial to make informed decisions and have a keen understanding of when it becomes necessary to release certain customers from your portfolio. This strategic approach ensures the overall success and sustainability of your business.