Some individuals initially perceive outsourcing primarily as a means of reduction—concerning office space, equipment, on-site personnel, and hiring expenses. While it is true that outsourcing can significantly reduce overhead costs, its fundamental value lies in the potential for expansion. Outsourcing serves as an effective strategy to facilitate growth within your organisation.

The manner in which your firm expands is largely influenced by the choice of outsourcing provider you decide to partner with. In this context, let us examine several key considerations to take into account when selecting a provider and how these factors can impact your firm’s growth trajectory.

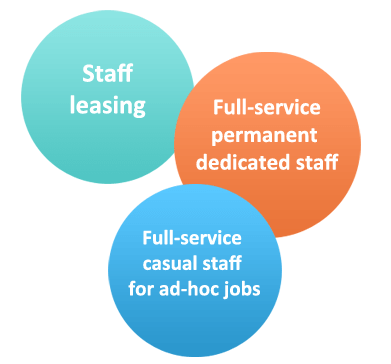

Staff leasing

In this operational framework, the service provider assists in the recruitment of offshore personnel and furnishes them with a dedicated workspace along with essential IT infrastructure. Certain providers adopting this model may offer preliminary induction training addressing fundamental issues pertinent to Australia or New Zealand, which may include several training sessions. Additionally, some providers may extend basic human resources support and staff management services. However, responsibility for most compliance and software training will rest with you, as your overseas team will depend significantly on the procedures and working documents that you supply.

Training can significantly consume a considerable amount of your workweek, particularly when it involves sending staff overseas to achieve the quality standards expected by clients. Developing an offshore team presents unique challenges that require careful consideration. Notably, several prominent Australian firms have operated their own offshore teams for years only to realise that the anticipated cost benefits diminish when accounting for the substantial time senior Australian staff invest in training and correcting errors. Consequently, these organisations have transitioned to utilising premium full-service providers for greater efficiency and effectiveness in their operations.

Full-service permanent dedicated staff

In this model, your outsourced accountants function as integral members of your team, operating remotely from overseas. You have the flexibility to determine whether you require a full-time or part-time accountant or bookkeeper, with options available for them to work between one to five days per week. They are equipped to handle your compliance tasks using the same methodologies employed by your in-house staff. Additionally, they can utilise your preferred accounting software and document management systems while becoming well-acquainted with your clients and their specific needs.

Engaging a premium full-service provider allows you to focus solely on managing workflow, whether by utilising your in-house procedures or by adopting the processes employed by the provider.

It is essential to evaluate the training and expertise of the staff at these providers regarding relevant tax laws, as this is a critical factor that directly impacts the level of support they offer.

This approach not only facilitates a reduction in review times but also enhances overall efficiency and broadens your service offerings. Furthermore, your overseas team can participate in staff meetings through platforms such as Skype and are equipped to handle more complex tasks beyond standard compliance requirements.

A premier full-service provider should enable you to allocate significantly more time towards expanding your firm and engaging directly with clients.

Full-service casual staff for ad-hoc jobs

If your workload does not justify the engagement of a part-time accountant, you might consider exploring a casual accounting option that better aligns with your needs.

With this model, you will primarily focus on managing your workflow, as the staff provided will already be trained and experienced in the specific tasks you require. This staffing option offers significant advantages; for instance, you can assign ad-hoc projects whenever necessary, such as during peak workload periods. Additionally, if your requirements for SMSF jobs are limited and maintaining an in-house employee’s knowledge of compliance regulations is not feasible, outsourcing this aspect of accounting to a specialist may be more efficient.

Engaging a provider for SMSF services can be particularly advantageous if there are concerns regarding staff turnover and the potential loss of accrued expertise. However, it is important to note that providers typically prefer to utilise their own procedures and documentation due to time constraints associated with familiarising their team members with your firm’s internal processes.